Tailored solutions to suit client needs

We work with insurers, brokers, MGAs, corporates and public entities to deliver great customer service and improved underwriting performance, through efficient management of the claims process.

Services

Our people

Allison Carr

Chief Executive Officer (UK&I)

Gary Fitzpatrick

Chief Strategy & Development Officer (UK&I)

James McEwen

Chief Client Officer (UK&I)

Jo Wells

Chief Finance Officer (UK&I)

John Salt

Chief Information Officer (UK&I)

Laura Warwick

Chief Operating Officer, Complex & Specialty (UK&I)

Liz Meagher

Chief HR Officer (UK&I)

Richard Greer

Chief Operating Officer, Core & Volume (UK&I)

Pamela Davies

Market Director – Personal Lines (UK&I)

Andrew Evans

Market Director – Broking & Major Risks (UK&I)

Samantha Ramen

Market Director – Commercial Lines (UK&I)

Connie Cobb

Market Director – Specialty Lines (UK&I)

Conor Kennedy

Head of Ireland Claims

Enrico De Micco

Director of Claims - Italy

Working With Us

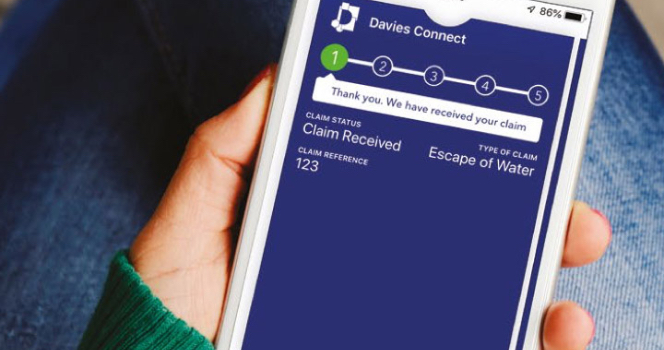

We enhance our service with technology to deliver cost and time savings to our customers.

How we've helped our clients

Latest news & insights

Featured Articles

-

Trouble with tenants: Victory for our client in missing handrail case

-

Our thorough investigation saved legal costs in discontinued slip and fall claim

-

Article

Q&A: Davies on the claims handling applications of AI

This article was first published by Insurance Times. Jon Glover, director…

-

Article

Responsible Business is Good Business: How to Implement Responsible Business Initiatives

With sustainability and ethical conduct becoming increasingly important to the modern-day…