People have a natural desire for competition and achievement. The idea of a game and being rewarded is very familiar to us and is something that can trigger powerful emotions and memories.

Gamification is the incorporation of game-like principals and elements (like point or reward systems) into otherwise non-game environments. Features can be added to tasks as incentives for people to participate, engage, retain knowledge and stay motivated.

We sat down with Archana (Archie) Iyer, a Director from our People and Organisational Performance practice and George Holman, a Partner from Banking and Markets EMEA. Together, they use their expert knowledge to shine a light on what gamification actually is and how using it in the highly regulated financial services industry can be a great return on investment.

Archie, as a People & Organisational Performance specialist, what would be your top three pieces of advice when designing and delivering courses for Gen-Zs/Millennials?

As someone who has designed quite a few programs for Gen-Zs and being a Millennial myself, I would say the three key things are:

- Presenting the content in a manner that is relevant to the audience and referencing things that they can relate to. Often, examples of older technology, days, movies etc., can distance the audience from the topic.

- Using multiple brain techniques to teach a concept. For example, using different styles that cater to audiences, such as Visual Auditory Kinaesthetic (VAK). Overall, we need to consider that people learn at different rates, and need different styles and approaches. This is especially true of Gen-Zs and Millennials as they are used to having more choice.

- Most importantly, designing the course/intervention in a manner that can engage this audience and keep their attention through to the end. Research shows that attention span has decreased from generation to generation, with Gen Zs having an average attention span of around 2.7 minutes.

George, having worked in major banks and financial institutions, can you share some of the learning experiences you’ve previously had?

I am a strong advocate of the saying “Every day is a school day”. On an individual level, we should never stop learning. At an organisational level, we should support and challenge our people to continually upskill themselves and those around them. I can vividly remember some of the best and most impactful learning experiences I’ve been fortunate enough to participate in.

A good example would be a training session to strengthen teamwork. After some time spent on theory, my team were thrust into a hypothetical situation (a plane crash on a desert island) and had to work together to find the best solution, with regular story updates requiring us to course-correct our conversations and suggestions. There was no right answer. It was more about how we came together as a group, worked together, built trust, negotiated and operated under pressure. I have gone on to use that exercise myself in group interviews!

So, in summary, the experiences that stuck with me were those that were immersive, created an emotional connection and made me want to retain the knowledge.

What does the term gamification mean to you?

Archie: Let me begin with an example – school children need to learn the periodic table but learning it as is involves only linguistic and logical aspects of their brain. As a result, kids get bored or find it to be a tedious task. Even if they learn it by heart, their information retention is not great. Imagine they learnt the table as a rap song, with the elements being the lyrics. They are then more engaged while learning, remember it for longer, and use the creative side of their brain. That is an example of gamification. Gamification is the aspect of adding a game element to something.

It makes the process of teaching and learning enjoyable, energises it, and makes it stick in your brain. Using it in learning interventions guarantees engagement and stickiness. In fact, I actually did learn the periodic table as a song with a melody thanks to my science teacher and I remember it to this date!

It makes the process of teaching and learning enjoyable, energises it, and makes it stick in your brain. Using it in learning interventions guarantees engagement and stickiness. In fact, I actually did learn the periodic table as a song with a melody thanks to my science teacher and I remember it to this date!

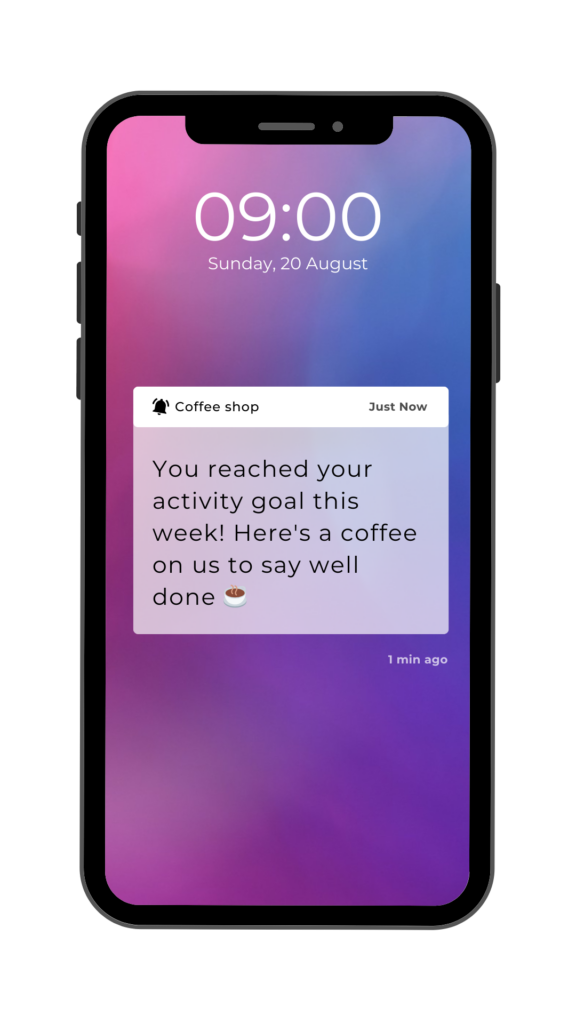

George: People seem to land on different interpretations of the term ‘gamification’. For me, it is about taking gaming concepts and applying them to non-gaming environments. How good do you feel when you fill up a loyalty card at your coffee shop of choice? Or when you win a challenge on your favourite exercise tracking or navigation app and receive kudos, badges and likes?

These are forms of gamification. It is about how we focus, recognise and reward people for achieving goals, which could be individual or collective.

Is gamification really appropriate for training in a highly regulated financial services industry?

Archie: Is it wrong to have fun while learning a technical concept in a regulated environment if the course is appropriate and follows guidelines? We start assuming that clients and stakeholders only want PowerPoint/lecture-based training because that is how it has always been. I can tell you from experience and overall research that it’s not true and that most financial services organisations, along with other industries, are looking to push the envelope with training and development.

They understand that attention spans are not what they used to be, learning styles and preferences have changed and that if they need to upskill their members, especially the Gen Zs and Millennials, then more traditional methods might not be best.

George: In short, yes absolutely. As experts in learning and development, our focus should be on participants’ engagement in workplace training, regardless of the underlying subject matter. If anything, gamification can actually make technical training and upskilling (which is typically less fun) more engaging and motivating for the receiver. This can ultimately lead to a better return on our investment.

What advice would you give to a firm looking to embed gamification into their learning?

Archie: My top advice would be to be open to experimentation and work closely with the learning consultants and training team. Share your requirements in detail to truly understand your audience and partner with the learning consultants to build gamified training. So far, all the best gamified learning we have built for clients has worked superbly because they worked with us. We brought in the ideas, the clients brought in their subject matter expertise and together, we built and perfected the gamified learning programme.

George: I would encourage organisations to focus on knowledge retention. There is a well-known principle in training called the ‘forgetting curve’ – essentially, information is lost over time when the receiver doesn’t try to retain it. The level of retention typically relies on two things: the strength of the memory and the time that has passed since the learning.

However, there are also techniques that we can use to improve recall. The first is to make training more interactive and immersive – which gamification helps with. The second is to reinforce the training regularly, ideally in a fun, flexible and efficient way.

What are some examples of gamified learning?

Archie: Here are a few examples:

- We used a murder mystery to teach a client group collaboration, influencing skills, psychological safety and trust building.

- We used theatre techniques (watching and directing a play) to talk about better communication, making meetings and presentations more effective and improving organisational culture.

- Banking games and simulations to teach some banking concepts.

- Trading games to teach negotiation strategies.

- We have also gamified simple training by including fun competitive quizzes and other elements to it.

What made you want to collaborate on this topic? Are there any collaborative opportunities in the pipeline for you?

Archie: I would credit George for this. Despite being from a traditional banking and financial consulting background, he’s been very interested in learning and development overall and especially in using newer and more efficient techniques for banking clients. We have already explored a few collaborative opportunities and spoken to a potential client about designing and delivering a tailored learning intervention around banking and markets topics to recent graduates, using a gamified approach.

Oh and the answer to your puzzle at the start of this article? The digits are in alphabetical order: Eight, eleven, five, four, nine, one, seven, six, ten, three, twelve, two, zero.

George: Archie and I first connected on this topic when I visited India and her energy around this topic was fantastic. Since then, we have looked for opportunities to collaborate.

Our clients often speak to us about fusing together our market-leading learning and training experiences and interventions with our deep financial services subject matter expertise. Archie and I both feel that there is a real opportunity here that we would love to explore further with our clients, to introduce gamification to learning experiences within financial services. Every day is a school day, so why not make those learnings and teachings fun, engaging, interactive and rewarding?

If your interest is piqued by what you read and want to discuss more reach contact us here.