At Davies we are acutely aware that, as the pace of regulatory change continues, so the burden on financial institutions increases. Overlay this with out-of-date regulatory obligation libraries that are stored in disparate locations, and duplicative and inconsistent across business units, and you have a very substantial challenge on your hands.

But the good news is that resolving exactly this type of complexity is a challenge we gladly accept!

Our Regulatory Change team has developed a framework to help financial institutions get their GRC ecosystem in order. We understand that the process does not have to be linear and that different elements of the ecosystem can be tackled at different times.

The drivers impacting each client determine the entry point; some clients are tactically focused on their inventory, while others choose to focus on their platform. At Davies we can focus on any one of the quadrants.

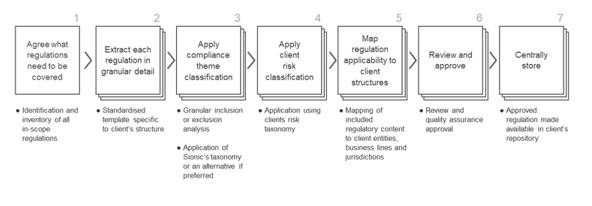

Our seven-step Regulatory Inventory approach runs in partnership with our clients to identify relevant regulations and cut-away unnecessary or irrelevant content, allowing for sustainable and focused updating of inventories. Working with key technology partners, we deliver relevant and timely regulatory updates, focusing on potential and actual changes, for ingestion, taxonomization and mapping into the control framework.

If you would like to discuss how we can help tackle the challenges you face, please contact us.