In today’s dynamic and highly regulated business environment, organizations face an ever-increasing burden of compliance responsibilities. Navigating through regulatory frameworks, initial and annual registrations, monitoring outside activities, and staying ahead of policy updates can be a daunting task for any company. As a former Chief Compliance Officer (CCO), I understand how the increasing regulatory burden of “business as usual” has changed and accelerated – a challenge for even the most experienced and fully staffed compliance areas. Let’s explore the concept of outsourcing compliance and how it can prove to be a strategic move for businesses in managing the complex landscape of regulatory requirements.

The Accidental CCO: The Challenge of Compliance Oversight

Many organizations find themselves in a challenging position when a key executive inadvertently becomes the ‘Accidental Chief Compliance Officer (CCO).’ This unplanned responsibility can be overwhelming, leading to potential risks due to insufficient expertise or resource allocation. Outsourcing compliance functions can provide specialized knowledge and resources, ensuring that compliance oversight is handled by experts in the field.

CE Monitoring and Reporting: The Importance of Continuous Evaluation

Continuous monitoring of employees’ compliance with ethical standards is crucial for maintaining a robust compliance program. Outsourcing this function allows companies to benefit from sophisticated monitoring tools and dedicated personnel, ensuring timely reporting and swift action in case of any deviations from compliance standards.

Registrations: Streamlining the Process

Initial Firm and Individual Registrations with the securities regulators can be a tedious and time-consuming process. Outsourcing this task to a specialized service provider can streamline the renewal process, reducing the administrative burden on internal teams, and minimizing the risk of overlooking critical deadlines.

Outside Activities Monitoring and Reporting: Mitigating Conflicts of Interest

Monitoring and reporting on Approved Persons outside activities are essential for identifying and mitigating conflicts of interest. An outsourced compliance model can efficiently handle this task, providing an objective perspective and ensuring that potential conflicts are addressed proactively.

Branch Audit Reviews: Creating Operational Excellence

Ensure compliance at every branch with our meticulous branch reviews. An outsourced compliance model can provide a fresh perspective and thorough assessments, identifying areas for improvement and ensuring regulatory consistency across all locations.

Policy and Procedure Updates: Ensuring Compliance Currency

Regulatory landscapes are subject to constant change, making it imperative for organizations to keep their policies and procedures up to date. Outsourcing compliance functions can ensure that the latest regulatory changes are promptly incorporated into internal policies and communicated throughout the organization, thereby reducing the risk of non-compliance.

Regulations Horizon Scanning: Staying Ahead of the Curve

Keeping an eye on the regulatory horizon is critical for anticipating changes that may impact the business. An outsourced compliance model can dedicate resources to continuously monitor and analyze regulatory developments, allowing organizations to adapt their strategies and processes proactively.

How an Outsourced Compliance Model Can Help

Cost Efficiency: Outsourcing compliance functions can be a cost-effective solution compared to maintaining an in-house compliance team, especially for smaller or mid-sized companies.

Expertise Access: Specialized compliance service providers bring a depth of knowledge and experience, ensuring that organizations benefit from the latest industry best practices.

Focus on Core Competencies: Outsourcing allows internal teams to concentrate on core business activities, leaving the intricate details of compliance management to dedicated professionals.

Scalability: Outsourced compliance models can scale up or down based on the organization’s needs, providing flexibility during periods of growth or contraction.

Risk Mitigation: By leveraging the expertise of compliance specialists, companies can reduce the risk of non-compliance, potential legal issues, and damage to their reputation.

Outsourcing compliance functions is not just about delegating tasks but strategically positioning the organization to navigate the complex regulatory landscape effectively. The benefits of specialized expertise, cost efficiency, and the ability to focus on core competencies make an outsourced compliance model a compelling solution for businesses looking to enhance their regulatory compliance efforts. As organizations continue to evolve, adopting a proactive approach to compliance through outsourcing can be a key driver of sustained success in today’s competitive business environment.

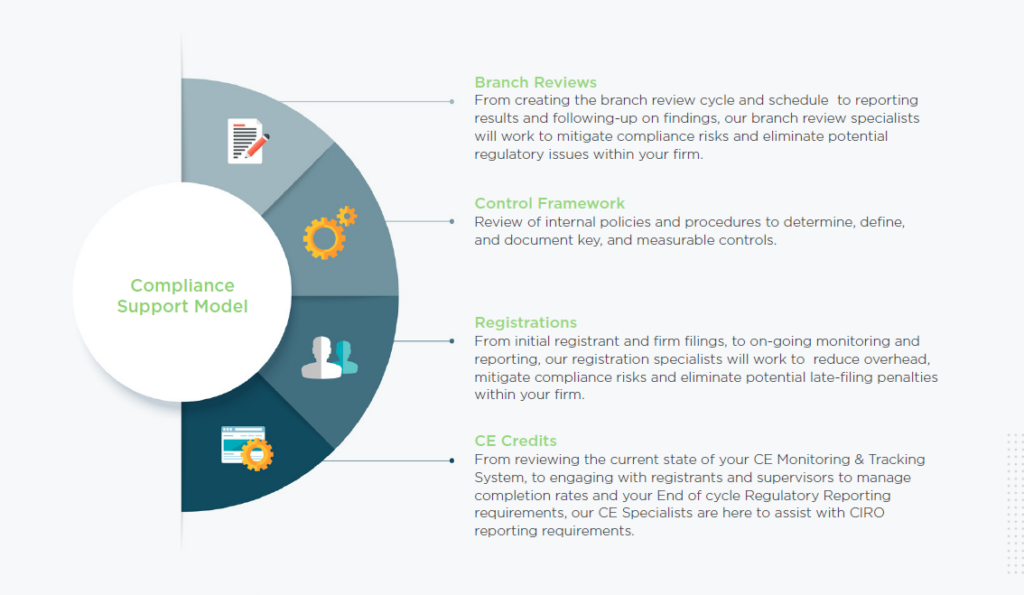

Davies Outsourcing Compliance Model: Elevate Your Compliance Strategy

Davies Outsourcing Compliance Model is your strategic partner in navigating the complexities of compliance, allowing your organization to thrive while mitigating risks effectively.

Our Comprehensive Solutions:

- Accidental CCO Rescue: Unplanned compliance responsibilities? Our experts step in to provide specialized oversight, ensuring compliance with confidence.

- CE Monitoring Excellence: Swift and accurate monitoring tools, coupled with dedicated personnel, guarantee continuous evaluation and immediate reporting.

- Seamless Approved Person Registrations: Streamline the initial (and renewal) registration process effortlessly, reducing administrative burdens, and eliminating the risk of missed deadlines.

- Conflict of Interest Resolution: Monitor and report on outside activities to identify and address conflicts of interest promptly. We keep your ethical standards intact.

- Branch Audit Reviews: Ensure branch compliance with our meticulous branch reviews. Our experts provide comprehensive assessments, identifying areas for improvement and reinforcing your commitment to regulatory standards.

- Policy and Procedure Prowess: Stay ahead with up-to-date policies. Our team ensures that the latest regulatory changes are seamlessly integrated, keeping you compliant and secure.

- Regulatory Horizon Mastery: Anticipate changes with our dedicated team scanning the regulatory horizon. We empower you to adapt strategies proactively and stay one step ahead.

Get in touch

If you’d like to know more, please contact us.