As the date to comply with DORA nears (17th January 2025), most firms have completed the foundational assessments and have materially progressed their implementations.

The range of Financial Entities in scope of DORA is broad. For some firms DORA’s applicability is clear and implementation programmes were mobilised a while ago. For others, the applicability is less clear-cut and programmes have been initiated more recently

If your firm is still in the process of implementing DORA, we can help!

Where are Most Firms?

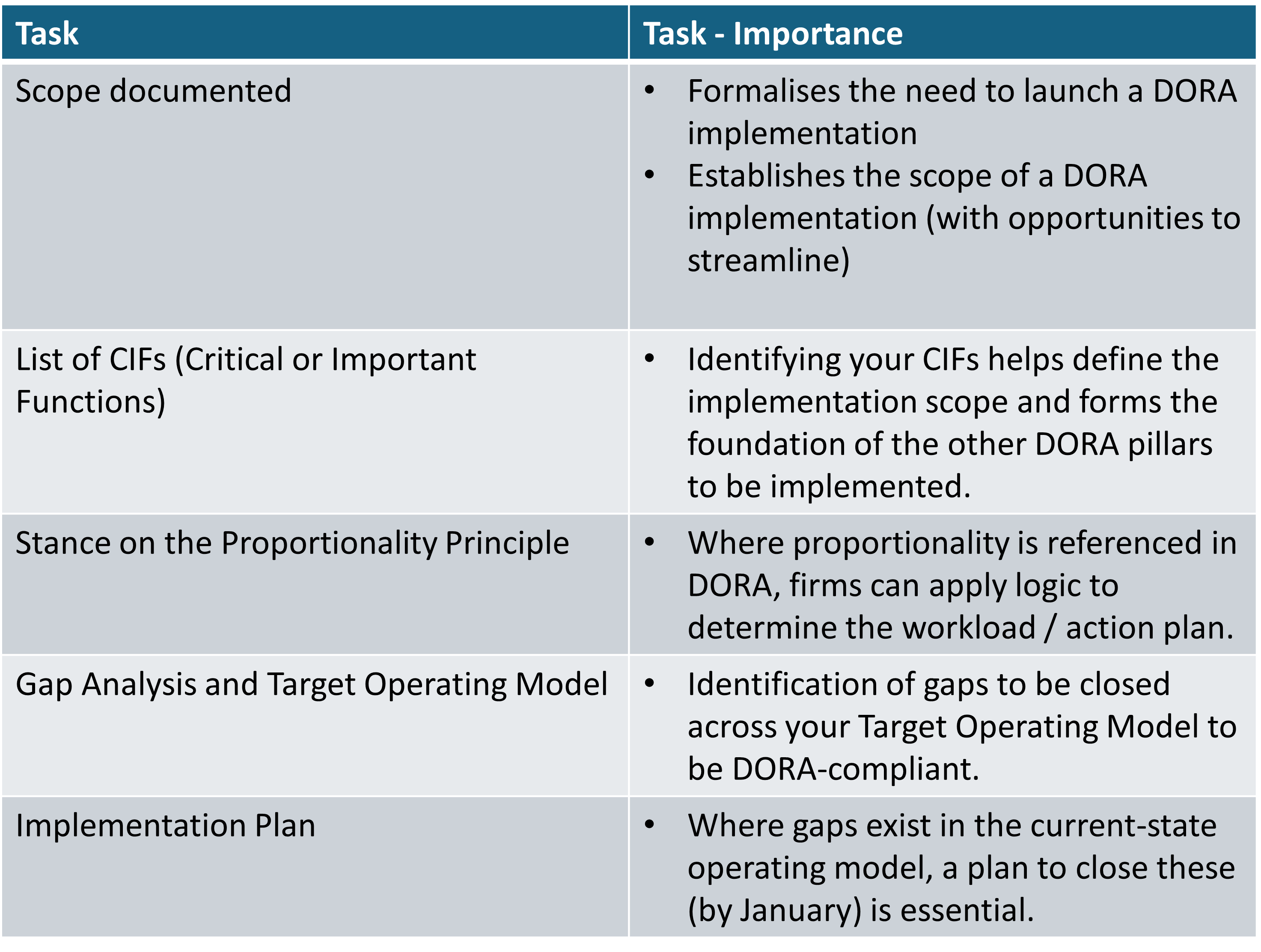

Most firms have completed their foundational analysis (summarised in the table below) and are now implementing the plans generated off the back of their gap-analysis exercise.

Where is Your Firm? How can we help?

Firms whose implementation is well-advanced:

We provide design reviews and assurance ensuring that your implementation approach and outputs adhere to industry best practices.

Our specialist resources can assist in the final stages of your implementations, powering it through to a successful conclusion.

Firms in the earlier stages of implementation:

We have templates that can accelerate you through the foundational assessments helping you to rapidly:

- Document scope

- Define your list of CIFs

- Take a stance around the Proportionality principle

- Mobilise a plan and gap analysis

- Move into execution-mode

Ready to Accelerate Your DORA Compliance?

We’d love to discuss how our templates and specialist support can accelerate your DORA implementation. Whether you need help with foundational assessments or executing your detailed plan, we’re here to assist.