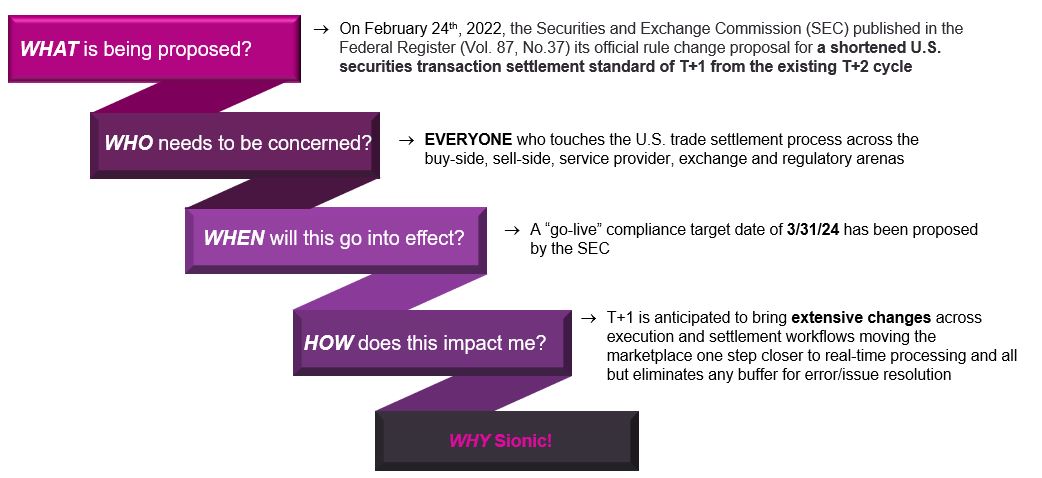

On February 24th, 2022, the US Securities and Exchange Commission (SEC) published in the Federal Register (Vol. 87, No.37) its official rule change proposal for a shortened US securities transaction settlement standard of T+1 from the existing T+2 cycle.

Conversion to T+1 will have significant impacts on the participants, processes, and platforms involved with pre/post trade lifecycle activities.

It is essential that firms do not underestimate the challenges that lie ahead of them to successfully transition to a T+1 settlement cycle.

Download our short guide: The Road to T+1.

A successful conversion program entails many components including executive support, dedicated budget, strong governance, accountable stakeholders, and a well-organized project management function.

- Detailed planning is required encompassing deliverable timelines, milestones, development efforts, testing, and migration to remediate affected trade processing and asset servicing functions.

- Internal and external constituents (including clients, vendors, third party service providers and regulators) all need coordinated engagement to ensure a synchronized transition from T+2 to T+1.

- Documentation (new and amended), impact assessments and technology enhancements will all come into play concurrently, putting further strain on firms’ resources in addition to their day to day responsibilities.

Led by Banking & Markets experts Joseph Denci (left) and Allen Lewis (right) the Davies team brings solid credentials with a deep understanding of the US securities industry from the distinctive perspectives of market infrastructure utilities, broker-dealers, investment advisors, clearing brokers, and the asset management community.

We will safely navigate you over the hurdles in your implementation of T+1 compliance, drawing from our extensive experience in the financial services arena through partnerships with banks, the DTCC, global custodians, and securities exchanges.

- Speak to Davies’s specialists: contact us to arrange a call.

- Download our short guide: The Road to T+1.