Overview

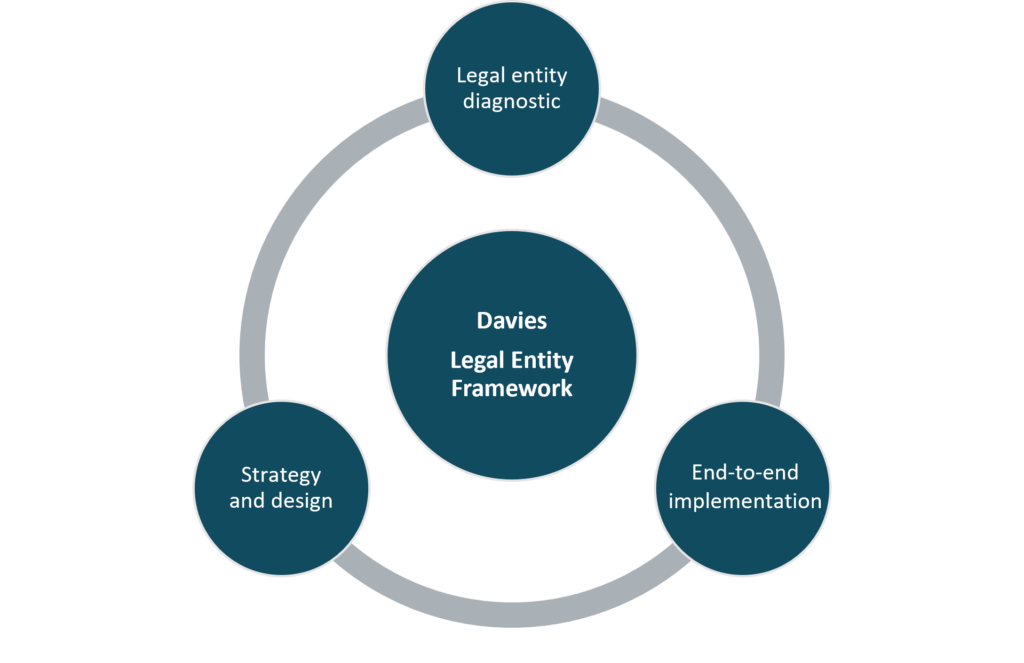

Executing legal entity change involves coordinating various functions, often with limited familiarity in similar programs and alongside regular responsibilities. Leveraging our extensive expertise and insights from past projects, we unite your teams to facilitate the seamless implementation of intricate changes.

Our legal entity change team is multidisciplinary, bringing expertise from across Davies’ practices and geographies. Regardless of our functional specialism (Finance, Tax, Operations, Risk etc.), we all have transformation experience. As a team, we like to work closely and collaboratively with our clients and leverage the relationships we have. This will not only speed things up but make some of the challenges like information gathering or other mobilisation activities that much easier.

Specialisms

We bring programme leadership and deep experience in multiple functions from Operations, Finance, Risk and IT – both of which are required to deliver forward-thinking strategies. Our SMEs can grapple with a broad range of LE change implementation challenges, including:

- Diagnostics of current state challenges

- Assessing scenarios and agreeing on LE strategy

- Licensing, authorisations and regulatory comms

- Client migration

- Financial Market Infrastructure/venue migration

- Business migration and business readiness

- Business change/approval processes

- Continued strategy validation and planning

We can offer skilled experts to manage and support at every level of the strategic entity change.

We have unrivalled experience in legal entity change. We have worked across a wide range of legal entity change initiatives across the three main global regions – EMEA, APAC and Americas. This experience includes:

- Target Operating Model design and set up of new entities

- Regulatory-driven implementations e.g., Ring-fencing, Brexit, UK Resolution and Resolvability etc.

- Integrations resulting from M&A

- Business cluster migrations

- Client engagement and repapering

- Expansion of entities via new product capabilities

- Legal entity licencing conversion – e.g., from a broker-dealer to a credit institution (bank)

- Subsidiarisation

- Entity rationalisation, entity elimination and non-strategic business wind-downs

Our approach is built on a foundation of deep, sector-specific expertise. Our team works exclusively in this space and brings practitioner-level understanding of the market structure and regulatory environment.

We consistently partner with leading industry organisations to address crucial emerging matters. Our collaboration extends globally, encompassing sell-side banks, regional and local commercial and wholesale banks, as well as exchanges, clearinghouses, and infrastructure providers.

This gives us a unique insight and allows us to draw perspective that helps us accelerate performance for our clients through our specialist IP.