In just over a year’s time, new Securities Financing Transaction Regulation – SFTR – is due to hit users of securities financing, including those lending securities, and the wider collateral markets. The introduction of reporting obligations for SFTs, new disclosure requirements and re-use of collateral, demand significant change and pose some serious challenges for the securities financing / lending industry and the collateral markets.

In the decade since the financial crisis, the Financial Stability Board (FSB) has laid the foundation for initiatives aimed at improving transparency. Now, SFTR is the EU’s latest response to the policy proposals first put forward in August 2013 on Securities Lending and Repos. As well as aiming to increase transparency in the securities financing market it also aims to improve monitoring of the shadow banking world.

Operating outside the regular banking system, shadow banking has grown quickly and quietly. But with success comes visibility – and inspection. The sector’s size, nature and systemic risk are now such that regulators are requiring transparency.

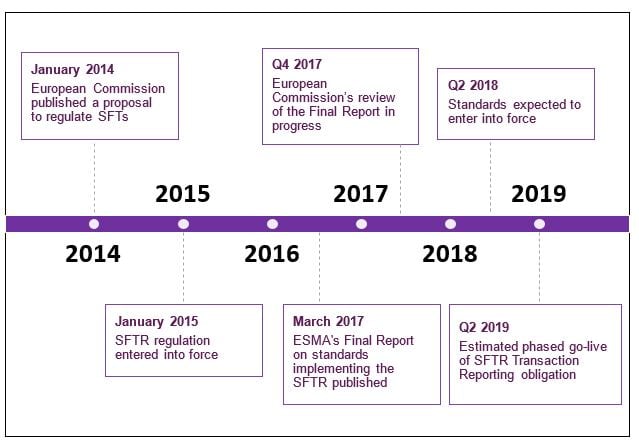

The SFTR proposals have been in place for some time with initial implementation in January 2016. The European Securities and Markets Authority (ESMA), as required, reviewed, and provided further detail on the Level 1 regulation and published regulatory technical standards (RTS) and implementing technical standards (ITS) at the end of March last year. These standards are currently being reviewed by the European Commission and are expected to be endorsed and written into the Official Journal in Q2 this year. When this occurs, ‘Go Live’ of the SFTR requirements begin 12 months later, using a phased-in approach.

My latest whitepaper tackles the details and scope of SFTR, describes the main challenges for our clients across both buy side and sell side and outlines our top 10 recommended steps to prepare for implementation.

Download our whitepaper on Securities Financing Transaction Regulation.

Whitepaper download

Note: This opinion piece was first published by Catalyst prior to the Davies merger