Financial regulation: mind-numbingly complex and expanding beyond traditional banking and into real estate. Who needs that? Well, everyone who is reliant on a healthy financial system (ie all of us) and even more acutely, the world’s most vulnerable citizens.

In June 2021, FINTRAC provided guidance on the strengthened regulations to align with technology advances and the evolving digital landscape to further protect our financial system. These expanding regulations cover all reporting entity sectors vulnerable to the movement of dirty money into assets that hold a stored value including real estate and crypto currency. More importantly, when REs implement strong controls aligned to the regulatory framework, they are playing a vital part in combatting financial crime and safeguarding the financial system and more importantly, protecting our community. FINTRAC recognizes the complexity of these changes and has provided a phased implementation timeline.

Let’s pretend that any real estate firm taking less notice that they should of the FINTRAC regulatory amendments in force since June has consciously decided to put their business at risk and face the personal liabilities and professional consequences. But there is a deeper, more sinister problem that FINTRAC aims to break: for our most vulnerable people, persisting in the status quo is a matter of life and death.

Overstatement? Not really. Here’s the deal.

As experts in financial crime and compliance, we at Davies don’t just understand what firms need to do to comply with regulation; we understand why regulations matter.

A strong Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) framework allows REs, such as real estate companies, to do good business and to report suspicious activities to FINTRAC and global financial intelligence units. Ultimately these reports find their way to law enforcement to combat financial crime. And make no mistake – financial crime is a sophisticated, successful, and fast-growing global business.

Criminal enterprises use real estate as a vehicle to maximize their profits and exploit vulnerable community members through modern day slavery. The global COVID-19 pandemic has exacerbated human rights atrocities where more than ever vulnerable citizens are exploited and demoralized in the pursuit of financial gain. In order to help us understand the magnitude and complexity of human trafficking, the US Department of State issued the 2021 Trafficking in Persons Report to monitor and combat trafficking in persons.

Facing the human cost of financial crime

According to the Canadian Ministry of Justice:

“Human trafficking involves the recruitment, transportation, harbouring and/ or exercising control, direction or influence over the movements of a person in order to exploit that person, typically through sexual exploitation or forced labour. It is often described as a modern form of slavery. Victims suffer physical or emotional abuse and often live and work in horrific conditions. They may also face fatal consequences if they attempt to escape. This crime represents a consistent and pervasive assault on the fundamental human rights of its victims.”

If the problem feels overwhelming and remote, think again. Despite what people may think, Canada is a haven for actors in human trafficking and this issue is hyperlocal, as this video from Peel Regional Police describing trafficking in my own local community near Toronto makes all too clear.

This is a crime that hides in plain sight. Many cases of human trafficking are unreported, and survivors suffer in shame, silence and fear from their attackers. They also suffer from mistrust in the judicial system. Those at the greatest risk are marginalized groups, such as Indigenous women and girls; newcomers; LGBTQ2+ persons; persons with disabilities; and those individuals who are socially or economically disadvantaged.

Not us? Not so. With the rise in social media, COVID-19 isolation and increased cybercrime, any person may fall prey to a predator given the right set of circumstances.

Protect yourself, your firm and your neighbours: five fundamentals of effective AML and ATF

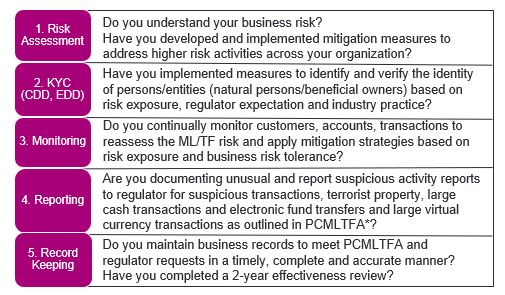

To protect your firm from regulatory failure and your neighbours from real human harm, you need an effective AML/ATF program with five critical components.

It is our collective responsibility to protect our communities in the financial services sector both as individuals and as financial crime professionals. This means continually strengthening controls to detect, deter and prevent criminal proceeds from entering our financial system.

The July 30 United Nations World Day Against Trafficking in Persons gives us time to understand and reflect on the human aspect of financial crime and the toll it takes in our society. FINTRAC should empower us to enhance RE’s compliance and AML/ATF programs to ultimately improve our citizens’ safety and well-being by reporting suspicious events. And as we stand together, we can make a difference by reporting and ultimately catching the truly bad actors who require access to our financial system.

To find out how Davies can help you to comply with FINTRAC or any other aspect of financial regulation swiftly and effectively, contact me.

If you’d like to help break the chain of human trafficking, these resources may help:

- United Nations World Day Against Trafficking

- Human Trafficking -The Signs – YouTube

- Signs of Human Trafficking – The Canadian Centre To End Human Trafficking

- Canadian Human Trafficking Hotline (24/7/365) at 1-833-900-1010

- Elizabeth Fry Society Peel-Halton

- SAVIS – SAVIS of Halton