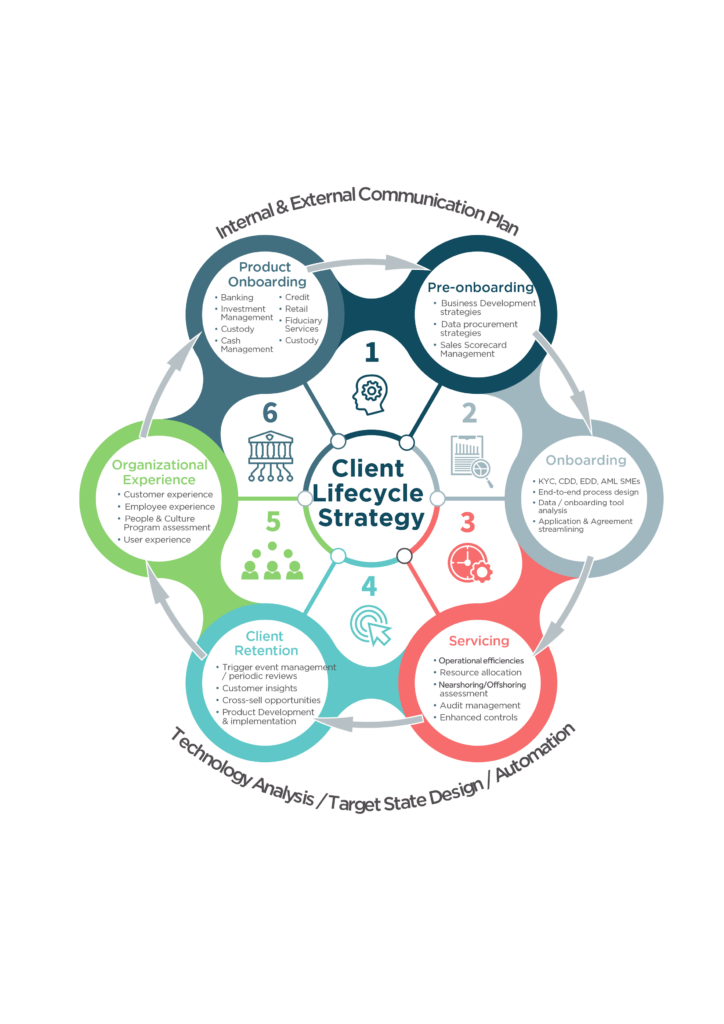

Client Lifecycle Management (CLM) is a critical aspect of any business’ operations. It encompasses the entire journey of a client, from initial contact to ongoing relationship management, through to offboarding. Selecting the right CLM tool is of paramount importance as it can significantly enhance the efficiency, effectiveness, and overall success of your business, by shifting the cost and burden of client onboarding to a competitive advantage.

In this article, we explore key reasons why choosing the right CLM tool is crucial.

Streamlined Client Onboarding

A robust CLM tool simplifies and automates the client onboarding process. It reduces paperwork, accelerates approvals, and ensures a smooth and hassle-free experience for clients, while simultaneously enhancing the employee experience and ways of working.

Enhanced Compliance

Compliance with industry regulations is non-negotiable. The right CLM tool will offer a robust rules engine that will help you stay compliant by centralizing and automating compliance checks, documentation, and reporting, reducing the risk of costly fines and reputational damage.

Improved Efficiency

Efficiency gains are one of the most significant benefits of a well-chosen CLM tool. It minimizes manual data entry, reduces operational errors, and allows your team to focus on higher-value tasks, ultimately boosting productivity.

Personalized Client Engagement

Tailored client experiences are key to building strong, lasting relationships. A good CLM tool helps gather and analyze client data, enabling you to personalize communications, offers, and services based on individual preferences and behaviors.

Scalability

Your business is likely to grow, and your CLM tool should grow with it. Scalability ensures that you can easily adapt and expand your CLM processes without major disruptions or costly migrations.

Data Security

Protecting client data is paramount. A robust CLM tool offers robust security features, encryption, and access controls to safeguard sensitive client information, ensuring trust and confidentiality and allowing your organization to remain compliant with the relevant data regulations (e.g. GDPR).

Analytics, Insights & Reporting

Informed decision-making is critical. The right CLM tool provides valuable insights through analytics and reporting, helping you identify trends, opportunities, and areas for improvement in your client relationships, and allows for effective management of KPIs and KRIs.

System Integration

An effective CLM tool provides easy integration with upstream applications and downstream systems, allowing for a streamlined experience, from onboarding to operations, to compliance, to legal and other departments involved in the journey.

Cost Savings

While there is an initial investment in selecting and implementing a CLM tool, the long-term cost savings in terms of reduced manual work, improved client retention, and compliance management can be substantial.

In today’s competitive business landscape, selecting the right Client Lifecycle Management tool is not merely an option but a necessity. Davies has established working relationships with the top CLM tool providers, and we can help your business assess and select the most appropriate tool that aligns with your business goals and strategy. A tool that can transform the way you acquire, manage, and retain clients, leading to minimized risk, increased efficiency, and profitability.

If you would like to find out more, please contact us.