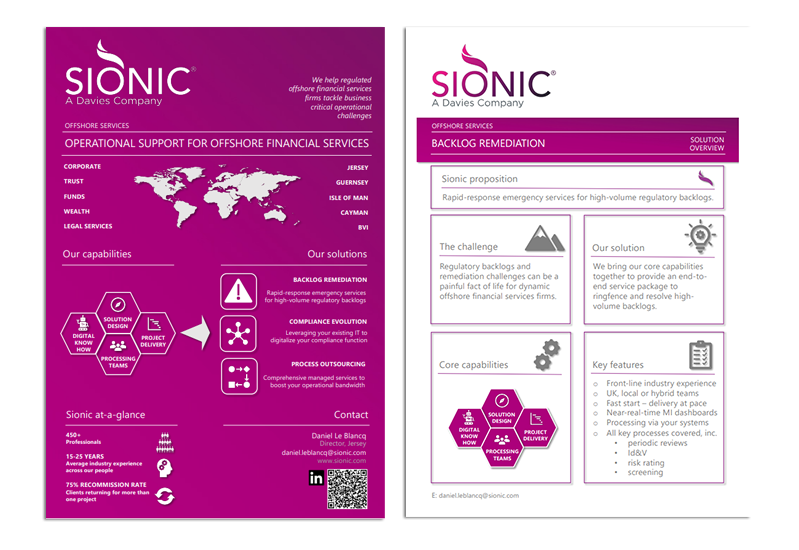

Davies’s specialist offshore team has announced a new service, specifically designed to help regulated offshore firms tackle backlogs in crucial, high-volume compliance processes including periodic reviews, risk rating, identification and verification, enhanced due diligence and sanctions screening.

Led by offshore specialist Dan Le Blancq the team is based in Jersey, Channel Islands and covers Jersey, Guernsey, the Cayman Islands and British Virgin Isles.

Dan Le Blancq says:

“Backlogs often arise under BAU conditions, or as a result of remediation requirements following an inspection. In either case, regulated firms need to act swiftly to tackle the build-up and get compliance KPIs back on an even keel. This is exactly where Davies can help.

It’s super-important to firmly grip unexpected backlogs and remediation situations. They can be hugely disruptive to day-to-day operations, badly distract from client service delivery, and strip away scarce resources from other important projects. We work with regulated firms, helping them to ringfence the problem, and then providing the processing capacity they need, for as long as required, to resolve the backlog.”

Scott Lee, Managing Partner and head of Davies’s Wealth Management & Private Banking practice, adds:

“This kind of service demands an integrated approach, bringing together deep domain experience and project management expertise, with efficient and scalable outsourcing teams. The breadth of our expertise enables us to package this all under one roof to provide a comprehensive, joined-up solution for offshore firms.”

- To find out more about this new service, please contact us.

- You can also download a summary of this new service here.