Reserve development in workers’ compensation and commercial auto: A persistent divergence

By Derek Chapman, Senior Principal, Actuarial Solutions.

The Casualty Actuarial Society published a great article earlier this year by Jim Weiss: Commercial Auto and Workers’ Comp: The Neverending Story of Two Remarkable Lines. Whether you are an actuary or not, reading it is well worth your time if you have interest in commercial lines’ profitability. It includes a thorough discussion of commercial auto profitability compared to workers compensation – the former has had a run of combined ratios over 100% going back to 2011 while workers compensation has been consistently well below 100% from 2015 until now, with many years’ combined ratio under 90%.

Reserve development by line of business

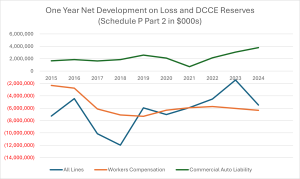

While most of the CAS article mostly focuses on profitability, we’ve noted the same phenomenon on the reserve development side as well. As shown in the chart below, industry commercial auto reserve development has been adverse every year of the last ten, averaging around $2 billion of one-year development (peaking last year at $3.7 billion in calendar year 2024). Workers compensation has been on a run of favorable development, averaging around $6 billion of favorable development each calendar year. Note that positive numbers indicate that the reserves carried in the previous year-end financial statement were inadequate, and negative numbers indicate that that carried reserves were redundant.

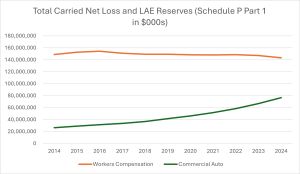

It is worth also noting that this pattern of commercial auto reserve inadequacy compared to workers compensation reserve redundancy is despite commercial auto reserves growing dramatically over the last ten years. In 2014, industry workers compensation net reserves were over five times greater that industry commercial auto reserves; in 2024, that ratio is less than two. Commercial auto premiums have also grown significantly, but not as fast as carried reserves. From 2014 to 2024, net commercial auto liability earned premium grew by 138% while carried net reserves grew by 190%. Workers compensation premium grew by only 7% over this time span while carried net reserves declined by 4%.

The ramifications of reserve development

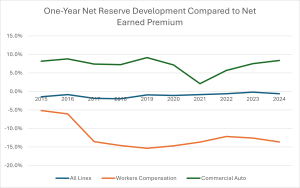

The impact on calendar year income from one-year reserve development is significant. Favorable reserve development has produced income around 14% of earned premium each of the last eight years for workers compensation. For commercial auto liability, adverse reserve development has generated a calendar year loss greater than 7% in nine of the last ten years (2021 was the exception given the lower loss levels in the 2020 accident year).

This persistent adverse commercial auto reserve development doesn’t just drag on operating results. It complicates financial forecasting and can lead to consistent underpricing if the carried reserves reflect management’s view of the business.

Underlying differences affecting reserve development

So, what is driving this difference in reserve development across lines? On the workers compensation side, there is likely general conservatism built into the loss reserves. There have been favorable trends in loss prevention, medical care, and claim management that reduce claim frequency and get injured workers back on the job more quickly. Loss ratios have been low, and company management has been comfortable carrying conservative reserves.

Commercial auto has been exposed to very high loss trends whether due to distracted driving or high inflation affecting the cost to replace or repair vehicles (in contrast to workers compensation where medical care CPI has grown more modestly and indemnity is often limited by statute). And of course, everyone’s least favorite buzzword “social inflation” has been a major factor in commercial auto’s story. The bulk of auto liability reserves after a few months relate to bodily injury claims and defense costs. Increased attorney activity, escalating jury awards & settlements, and COVID-related court disruptions have all played their parts for liability lines while workers compensation has been less affected, but the adverse reserve development notably predates the pandemic.

In the Insurance Information Institute’s “Trends and Insights: Commercial Auto,” Triple-I notes a study from the National Safety Council that deaths due to preventable traffic crashes were 22 percent higher in 2022 compared to pre-pandemic levels, and notes a study from Cambridge Mobile Telematics showing distracted driving increasing 20 percent from 2020 to 2022. A Triple-I study found that attorney representation in commercial auto claims drove a 21 percent increase in loss costs from 2015 to 2019, and that trucking is particularly affected.

Reserving in the face of uncertainty

It is difficult to correctly set either case reserves or IBNR in an era of rapidly increasing claim costs. Case reserves that are weaker today relative to ultimate claim costs compared to in the past drive up loss development patterns. As actuaries, we prefer to look at multi-year averages but that can lead us to mistakenly attribute recent increases in loss development and severities to natural volatility. If you set current year reserves assuming that rates are adequate when they are not, you create a feedback loop where reserves are too low and the biased picture of profitability produces rate indications that understate the amount of increase needed, leading to further rate inadequacy.

What can we do to increase the accuracy of reserves in such an environment?

- Update default case reserves regularly and consistent with observed trends in claim severity

- Place greater weight on the most recent loss development patterns if it is clear that claim development has deteriorated

- Use a realistic starting point with reserving methods that rely on expected loss ratios Don’t assume that a permissible loss ratio is the expected loss ratio unless rates are clearly adequate

- Consider reserving methods that incorporate loss trend, and include reasonability checks that reveal whether reserves accommodate high inflation levels

- Stay informed about all legal, legislative, and industry changes that could affect claim settlements, and any changes in a company’s defense and settlement strategy

If you would like to continue the conversation, get in touch with Senior Principal, Derek Chapman, at derek.chapman@us.davies-group.com