What is AI Underwriting Workbench?

Traditional systems of record, like policy administration, billing, claims, and legacy underwriting tools, were not built to support modern, scalable, data-driven underwriting. They are rigid, slow to

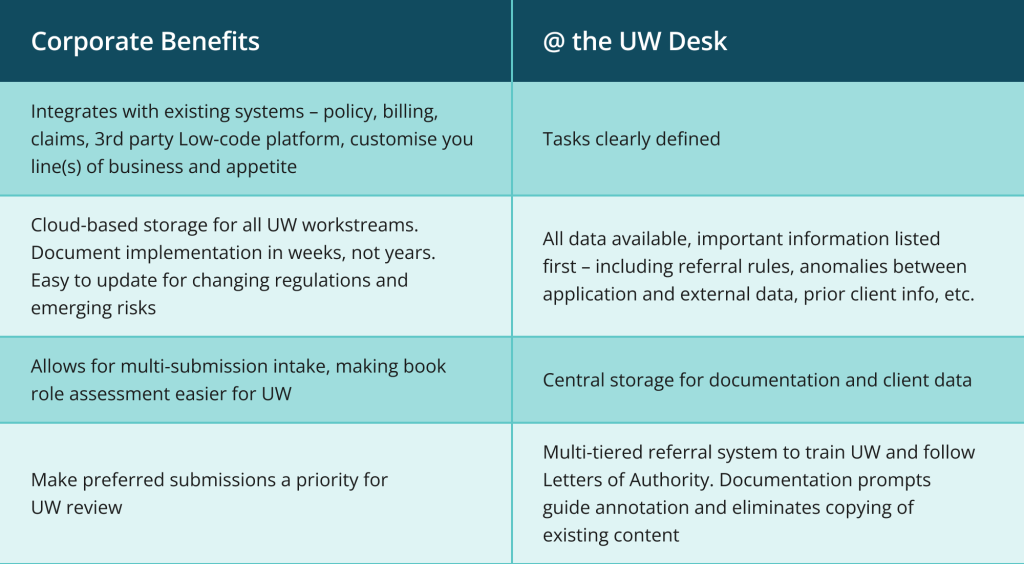

change, and costly to modernise. Davies recommends layering in a “Pane of Glass/Layer of Engagement”, Underwriting Workbench, to unify risk views, streamline workflows, and accelerate underwriting decisions without needing to replace existing systems.

1. Go Live in Weeks

With rapid configuration, flexible data models, and out-of-the-box API connectors, avoiding the time and cost of traditional transformation programs.

2. Plug into What You Already Have

By interfacing easily with our modular API middle layer with existing PAS, Claims, Billing, Rating, and DMS, eliminating the need for expensive rip-and-replace projects.

3. AI-Ready Foundation

Enables AI deployment for risk scoring, triage, and document classification directly within the Underwriting Workbench and accelerating real-world use cases without waiting on core system upgrades.

Our Offering

Comprehensive Features for Maximum Efficiency

Centralised interface:

Manages all underwriting tasks from one dashboard, giving a clear view of submissions and priorities and removing the need to access multiple systems.

Referral management system:

Tracks task progress and referrals for timely follow-ups & better team communication.

AI-powered rules engine:

Creates and automates underwriting rules to handle complex scenarios with precision and consistency.

Key Benefits

Maximise In-Place Technology Assets

The AI Underwriting Workbench optimises your existing tech investments and surfaces what’s important for your Underwriting team to complete tasks.