Powering MGAs & MGUs

Professional outsourcing solutions throughout the MGA& MGU lifecycle

Engineered for Your Success

Outsourcing can be a powerful tool when developing and growing a business, enhancing operations, and providing additional support. Our outsourcing solutions are designed to offer flexible and cost-effective services for the insurance community. We are equipped to handle numerous aspects, making us a one-stop shop for our clients, enabling them to focus on their business success.

We also serve as a conduit to fronting carriers, reinsurers, InsureTech solution providers, policy administration companies, third-party administrators, audit support providers, and additional experts. We can introduce you to the contacts needed to implement and operate insurance programs successfully.

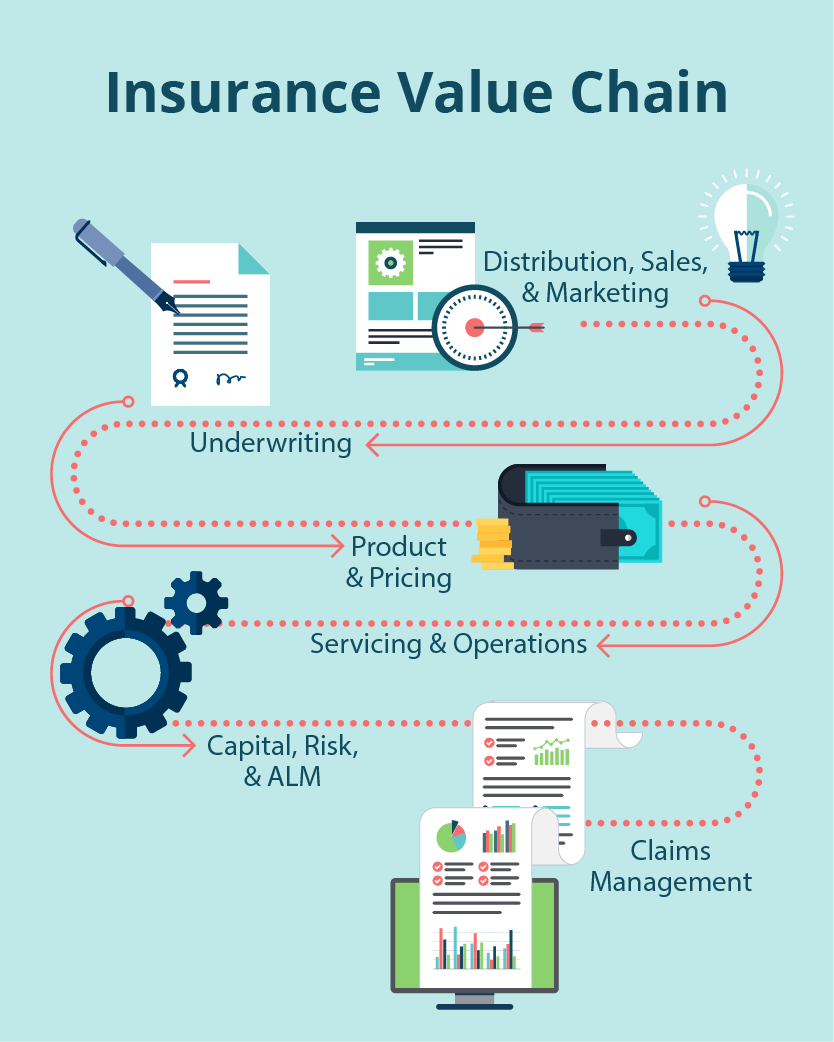

Supporting All Insurance Value Chain Stages

Today’s insurance value chain is highly fragmented. Insurers and MGAs are served by multiple providers at differing stages, which can lead to inefficiency and underperformance. Davies’ end-to-end range and depth of complementary services means that, for the first time, insurers and MGAs can access solutions across the entire insurance value chain with a single strategic partner.

A Variety of UK Market Entry Options

We specialize in UK market entry and professional support services for a variety of either start-up or mature MGAs, MGUs, (re)insurers, and other entities in the underwriting arena. Our extensive experience in the general UK and Lloyd’s insurance market provides for the following solutions:

MGA Launch

We operate as an independent incubator platform offering a “launch and host” service to entrepreneurs, private companies, and corporations looking to establish a Managing General Agent (MGA) in the UK. We utilize our FCA regulatory permissions under a UK Appointed Representative framework via our subsidiary, Davies MGA Services Limited.

Through collaboration, we ensure our clients have the resources and regulatory oversight framework to meet the highest regulatory standards while growing their business and meeting strategic goals. Other support services may include assistance with a complete FCA permissions application for a stand-alone UK MGA or support with Lloyd’s coverholder application with a sponsoring Lloyd’s Managing Agent.

Entry to Lloyd’s of London

Asta, a recent acquisition of Davies, is Lloyd’s leading third-party management agent, meaning it is truly independent and without capital at risk. Asta brings a long and proven track record and is a key contributor to market innovations, from formulating the syndicate start-up process to developing Lloyd’s SIAB framework.

Asta will not only work with you to ensure that your proposed business plan provides accretive value to Lloyd’s and meets their entry requirements but will also sponsor your application(s). They will then support you through the due diligence and decision stages and the implementation of your plan before securing final approval for you to start underwriting and expand into new markets.

Our Services

We operate as an independent incubator platform offering a “launch and host” service to entrepreneurs, private companies, and corporations looking to establish a Managing General Agent (MGA). We provide advising, consulting services, and FCA regulatory permissions under an Appointed Representative Framework. In the UK, we operate through our subsidiary, Davies MGA Services Limited.

Our team of experts delivers professional support services to existing fully authorized MGAs and general customized service support to entities involved in the delegated underwriting arena. Our top priority is to ensure that our clients have the resources and structured regulatory oversight controls and processes to guarantee that they meet the highest regulatory standards.

Through our subsidiary Davies Brokering Services, an FCA-authorized intermediary with Lloyd’s accreditation, we operate as an independent, fee-for-service, incubator platform offering a “launch and host” service to fledgling intermediaries in the UK. We utilize our FCA regulatory permissions under an Appointed Representative Framework and provide access to the Lloyd’s market via Davies Brokering Services brokering permissions.

We provide comprehensive capacity support services in a wide range of insurance areas, along with general service support to entities involved in the brokering and delegated underwriting arena. Our aim is to ensure that our clients feel secure and well-equipped, with the resources and structured regulatory oversight controls and processes in place to guarantee that they meet the highest regulatory standards.

We provide back office solutions, including technical premium and claims processing, risk data capture, entry, and quality control checking, endorsement processing, written to premium paid bordereaux processing and reconciliation, technical accounting support services, including statementing, credit control, debt management, and reporting, claims management including preparation of claims bordereaux, claims fund review and reconciliation, and temporary resource support.