Why are catastrophe (CAT) teams an identity and access risk?

August 17th 2021

-

March 8th 2022

Today’s Advancing Home Inspection Technology

If you’re looking for a true indication of what’s happening with today’s housing…

-

June 7th 2022

Why Require an Insurance Inspection?

As an insurance underwriter, an important factor in your decision-making regarding whether or…

-

February 5th 2025

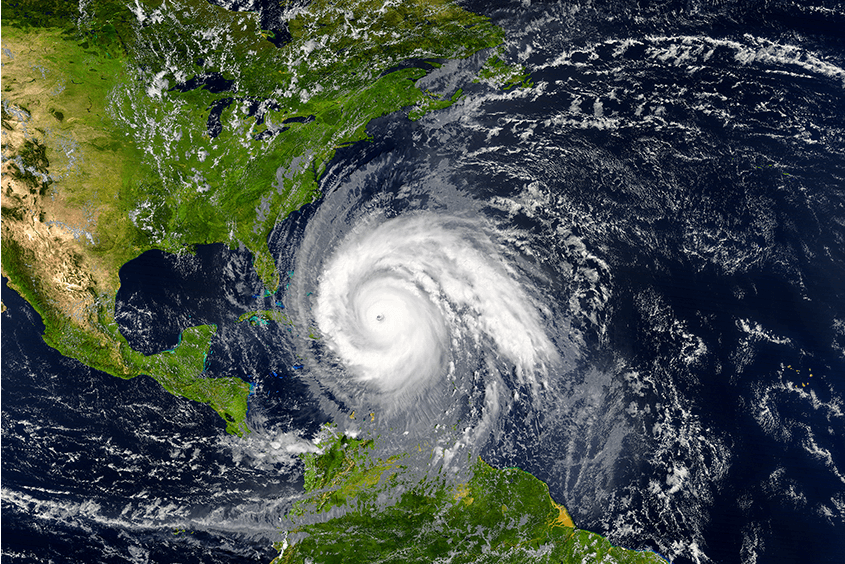

2024 CAT Season Recap: A Year of Unprecedented Storms & Lessons Learned

The 2024 Atlantic hurricane season will be remembered as one of the most…