Four Key Takeaways from Florida’s Legislative Property Insurance Overhaul

January 24th 2023

There are new property insurance rules for Florida’s insurance carriers requiring elaborate document and process changes.

Leading into the Christmas holiday, the Sunshine state’s legislature convened a special session in Tallahassee, where new property insurance regulations were passed. Part of the impetus for the updates is the lack of reinsurance available due to the catastrophic damage caused by recent hurricanes and the billions of dollars in resulting damage. Additionally, Florida’s insurance industry has been experiencing an increase number of claims within the “assignment of benefit” laws and unnecessary lawsuits.

Florida Senate Bill 2A went into effect on January 1, 2023, impacting the state’s insurance carriers in four critical regulatory areas: flood coverage disclosure, assignment of benefits changes, binding arbitration notification, and updated prompt pay laws. Per the bill’s own language, it “requires insurers to more promptly communicate, investigate, and pay valid claims.”

This is creating some new and complicated workflows for the state’s carriers. Here’s what they need to know.

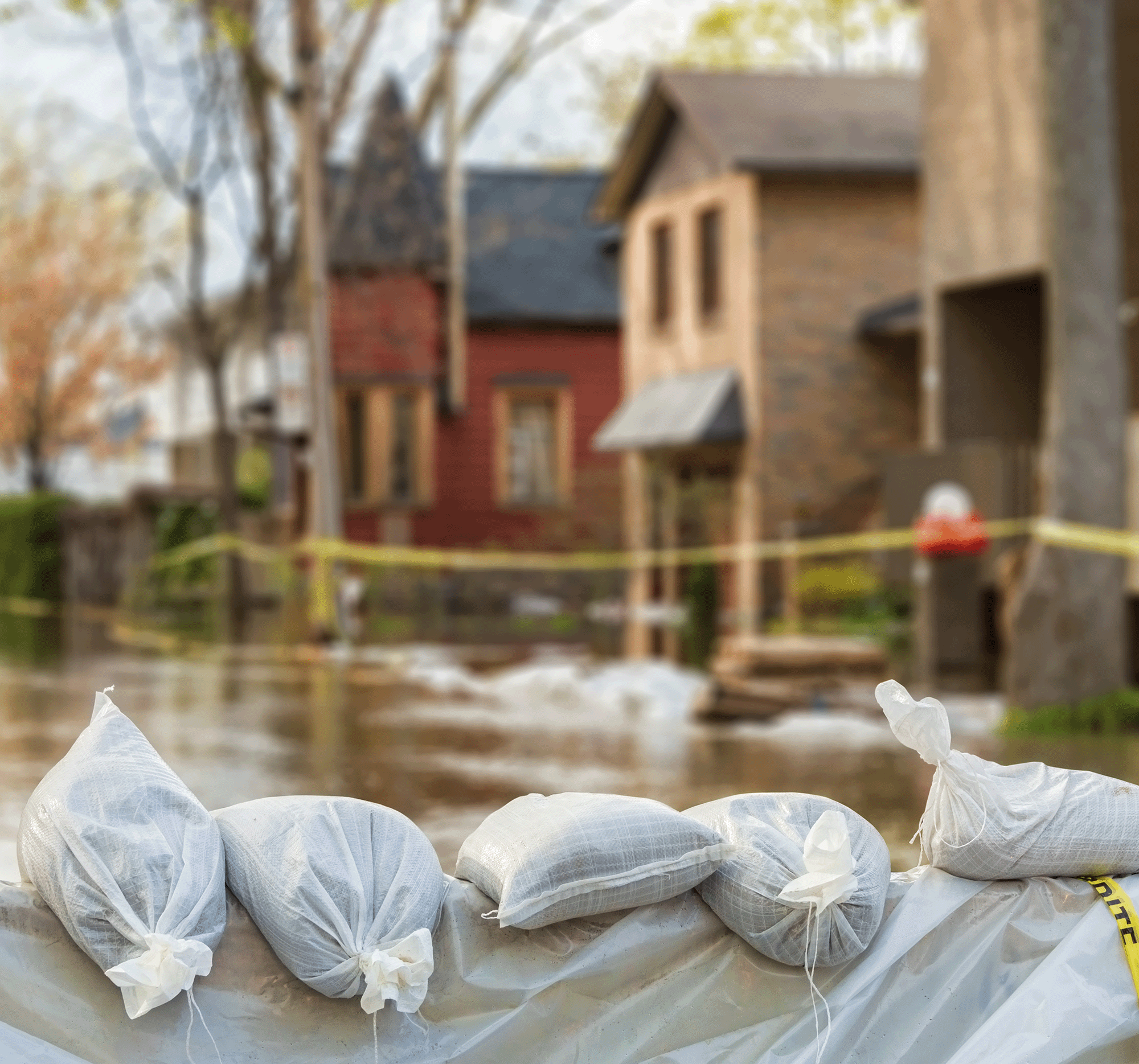

Flood Insurance Notice and Disclosure

Florida hurricanes are known to lead to flooding, and yet, some homeowners still elect not to invest in flood insurance failing to understand that flooding isn’t covered under their homeowner’s policy. As a result, the newly established law asserts that insurers issuing homeowner policies must submit a filing to the Florida Office of Insurance Regulation (FLOIR) to revise the mandatory flood insurance notice on the declarations page if flood insurance is not included within the existing policy. According to lawmakers, this notice should encourage homeowners to purchase flood insurance in addition to their homeowner’s policy. The required messaging must state:

“Flood insurance: You should consider the purchase of flood insurance. Your homeowner’s insurance policy does not include coverage for damage resulting from flood even if hurricane winds and rain caused the flood to occur. Without separate flood insurance coverage, your uncovered losses caused by flood are not covered. Please discuss the need to purchase separate flood insurance coverage with your insurance agent.”

No More Assignment of Property Benefits

Another sweeping change in the Florida law is that the assignment of benefits is no longer an option within property insurance policies. Therefore, any benefits resulting from a policy issued on or after January 1, 2023, is prohibited from being transferred to a third party.

Previously, a property owner could hire a contractor to begin work on their home without providing compensation, and instead, the contractor would seek payment from the insurance company. This is now prohibited as legislators believe it leads to costly litigation and higher premiums from disputed charges or payments after the work has been completed. The bill specifically states,

“… a policyholder may not assign, in whole or in part, any post-loss insurance benefit under any residential property insurance policy or under any commercial property insurance policy as that term is defined in s. 627.0625(1), issued on or after January 1, 2023. An attempt to assign post-loss property insurance benefits under such a policy is void, invalid, and unenforceable.”

Binding Arbitration Limitations

Senate Bill 2A provides conditions whereby an insurer may include mandatory binding arbitration in its policies. The law does this by clarifying that insurance companies may issue an optional endorsement related to mandatory arbitration with consent from policyholders. Additionally, a premium discount is required for policies with mandatory arbitration and insurers must offer the option of a policy without a mandatory binding arbitration clause. If the insured elects to have mandatory arbitration, that decision is binding and the right to file a lawsuit is waived.

This means that for full transparency, carriers must include the mandatory binding arbitration requirements in an attachment to the property insurance policy and the policyholder must sign a form electing to accept mandatory binding arbitration. Insurers must review their Rule manuals and file revisions with the FLOIR as applicable.

Prompt Pay Enhancements

To resolve and pay claims quicker, the law amends current prompt pay laws and associated claims policy language. As a result, any documentation regarding claims handling must include the following prompt pay updates, which must be fully implemented by March 1, 2023.

- The time for an insurer to pay or deny a claim is reduced from 90 to 60 days.

- The time for an insurer to review and acknowledge a claim is reduced from 14 to 7 days.

- The time for an insurer to begin a claim investigation is reduced from 14 to 7 days.

- The time for an insurer to conduct a physical claim inspection is reduced from 45 to 30 days.

- The policyholder has the right to receive a copy of a detailed estimate of the amount of the loss within 7 days after the estimate is generated by the adjustor.

Also, all claim records must include the various parts of the claim investigation and related dates. Insurers must review SB 2A to ensure compliance with all aspects of the Prompt Pay revisions.

Becoming Compliant

While these changes are substantial, the burden to modify existing processes and policy language doesn’t need to be an onerous challenge for Florida carriers. Davies understands the importance of becoming compliant. We can help insurers understand the revisions, how they impact internal documents or practices, assist in drafting the new language for your policies, and making the appropriate filings in Florida to remain compliant. The Davies team includes individuals with extensive experience working with the FLOIR and the Florida IRFS filing system.

-

April 11th 2022

Heightened Insurance Risk Posed By Climate Change

Natural disasters and climate change have been on peoples’ minds for several years and,…

-

June 7th 2022

Why Require an Insurance Inspection?

As an insurance underwriter, an important factor in your decision-making regarding whether or…

-

February 1st 2023

Black History Month: Insurance Industry Trailblazers

This month, we would like to shine a light on the African Americans…

-

March 1st 2023

Celebrating Women Who Tell Our Insurance Story

Few people realize that Women’s History Month has been celebrated in the U.S.…

-

August 8th 2023

Three Simple Ways to Provide Support to Your Customers During This Hurricane Season

Earlier this week, a massive storm system brought high winds and thunderstorms across…