Harnessing CAT Modeling & Climate Change: Insights from Ben Conrad

September 16th 2024

Catastrophic (CAT) modeling, the process of predicting the financial impact of natural disasters, has become a critical tool in managing risk and pricing insurance policies. To gain a deeper understanding of this field, we sat down with Ben Conrad, Senior Consulting Actuary, who shared his expert insights on how CAT modeling adapts to our changing world, the opportunities this presents, and what lies ahead.

The Climate Change Factor: A Shifting Baseline for CAT Models

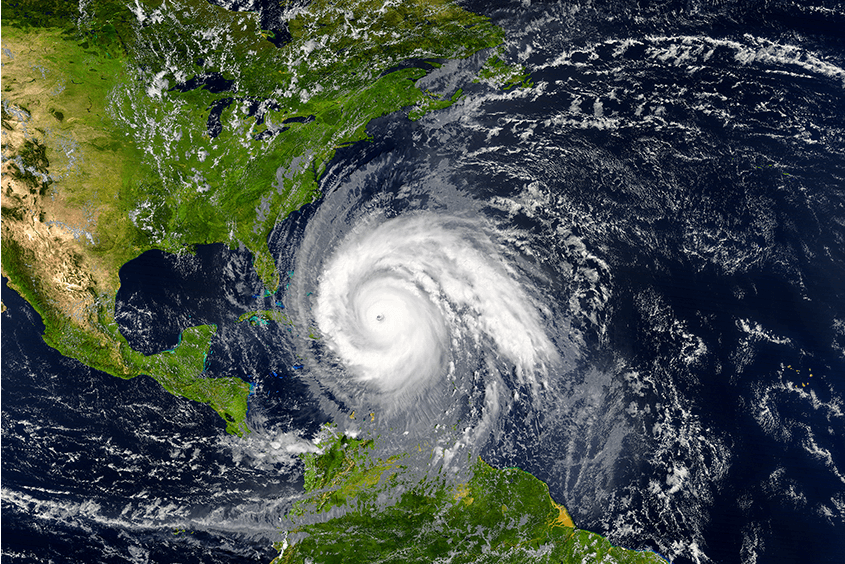

One of the most pressing influences on CAT modeling today is climate change. Conrad explained, “CAT models are constantly updated and refined based on the most up-to-date information. The modeling teams look at decades of data related to each type of catastrophe, and the modelers will capture the impact in their projected loss levels to the extent that climate change impacts the frequency or size of loss events over time.”

This need for continual updates is more crucial than ever, as globally insured losses from natural catastrophes reached $130 billion in 2022 alone, driven largely by extreme weather events like hurricanes, floods, and wildfires. However, the effects of climate change aren’t uniform, creating distinct challenges for different regions and perils. “We expect that different modeling teams will have different research and examination approaches to this and may emphasize recent observations more or less, which is why they have such a wide range of projections from different models,” Conrad adds.

The Broader Role of CAT Models in Innovation

Climate change isn’t the only factor shaping the role of CAT models in the insurance industry. Beyond their impact on rate setting, Conrad emphasized how CAT models are increasingly used to drive product development and underwriting innovation. “Product development teams use CAT model output to improve underwriting guidelines, target risk profiles, geographic capacity levels, reinsurance selections, policy packaging, and other risk-focused business actions,” he says.

The influence of these models goes deep into the core of how policies are structured. For example, CAT models are employed to calculate base rates and create more accurate risk ratings. Conrad elaborates, “Within the rating process for a product, CAT models are used to set base rates and create more accurate ratings at the risk level. A hurricane model in Florida may consider how far away from the coast each risk is when projecting loss.” The ability to fine-tune policies with this data is substantial—predictive models have reduced underwriting losses by 10-15% in certain risk categories, such as coastal property insurance.

Opportunities & Challenges in CAT Modeling

As CAT modeling becomes more sophisticated, the opportunities to enhance risk management have multiplied, but so have the challenges. Conrad pointed out that technological advancements and data analytics are increasingly critical in this field. “Insurance companies are capturing more loss details as data analytics and technology become more integrated into claims systems,” Conrad observed. This integration enables insurers to collect more precise data, improving the accuracy of CAT models.

This also aligns with broader industry trends—the global Insurtech market is expected to reach $10.14 billion by 2025, with data analytics being one of the key drivers of innovation. However, Conrad also points out that this data influx presents its own challenges. “The challenge is that identifying the impact of each risk characteristic based on limited or changing data is extremely difficult,” he says. As data evolves, so must the models, requiring insurers to stay nimble in a fast-moving environment.

Communicating CAT Modeling Results

With CAT modeling becoming more technical and integral to risk management, one of the key challenges in CAT modeling is communicating complex results to diverse stakeholders, from regulators to policyholders. Conrad advises a comprehensive approach: “It is important to communicate all impacts of CAT model results. Stakeholders may care the most about capital levels, and policyholders may care the most about changes to premiums from ratemaking; however, trying to communicate the entire picture is important for all audiences.”

According to a recent survey, 74% of policyholders are more likely to stay with their insurer if they receive clear, transparent explanations of rate changes. In his view, transparency is key, not just about the results but also the relative impact on the company and the industry. “When communicating CAT model results, it is important to discuss the relative impact of CAT models on your company versus the industry to keep things in perspective.”

The Future of CAT Modeling

Looking toward the future, Conrad sees significant advancements in CAT modeling driven by technological innovation and new risk considerations. “New hazards like Cyber and Pandemic are being modeled, more risk characteristics are being considered, and available data is more accurate than ever,” he says, adding that this trend will only accelerate in the next decade.

The expanding scope of CAT modeling is supported by the rise of new players in the industry. “As competition continues to increase, I expect we will see a wide variety of model results in the short term. In the long term, this will lead to higher quality models as we see which models prove themselves over time.” The growing focus on emerging perils reflects this shift—new catastrophe modeling for risks like cyber is projected to grow 30% annually through 2030.

Shaping the Path Forward With Davies

As climate change redefines risk landscapes, CAT modeling will be essential for insurers to stay ahead of emerging threats. Ben Conrad’s insights illuminate the challenges and opportunities ahead, underscoring the importance of innovation, data accuracy, and clear communication. By staying agile and informed, the insurance industry can turn these challenges into opportunities for growth and better risk management.

Interested in how CAT modeling and cutting-edge risk management solutions can benefit your business? Contact us Ben today at Ben.Conrad@us.davies-group.com to learn more about our industry-leading expertise in catastrophe modeling and loss control strategies.

Learn more about our Actuarial services here

-

April 4th 2024

Explore Atlanta After 2024 Spring Meeting

SCOPE I have examined the list of 5 fun things to do in…

-

August 4th 2021

Workers’ Compensation Risk Issues Facing PEO Investors

The substance of our M&A advisory support to clients can vary greatly due…

-

April 5th 2024

Achieving Mental Health Parity: Your Guide to NQTL Compliance

The Mental Health Parity and Addiction Equity Act (MHPAEA) aims to ensure your…

-

June 24th 2024

Lessons Learned From Actuarial Due Diligence

Take yourself back to those school days when you sat at the dining…

-

August 27th 2024

NQTL Testing: Proving Parity is Harder Than It Looks

The Mental Health Parity and Addiction Equity Act (MHPAEA) was designed to legislate…

-

February 5th 2025

2024 CAT Season Recap: A Year of Unprecedented Storms & Lessons Learned

The 2024 Atlantic hurricane season will be remembered as one of the most…

-

March 26th 2025

New Year, New Insights on Workers' Comp & EPLI Trends

As we step into 2025, the insurance landscape for workers’ compensation (WC) and…

-

April 22nd 2025

The Importance of Proactive CAT Claims Management

Efficient claims management during CAT events is crucial, not only for fulfilling obligations…

-

May 15th 2025

Simulating the Unthinkable: Lessons from Our 2024 Mock Catastrophe Event

When catastrophe strikes, there’s no time to waste. Rapid response, seamless coordination, and…