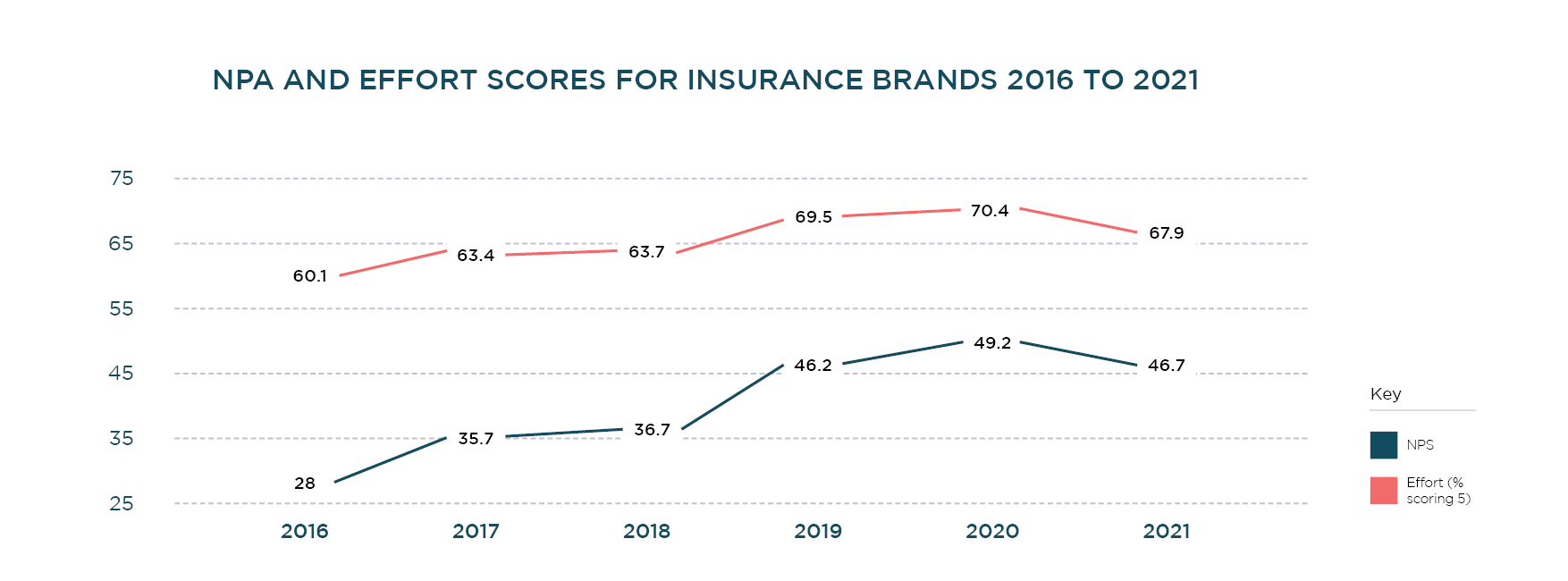

Davies has been monitoring NPS (Net Promotor Score) and CES (Customer Effort Score) via email surveys for the past six years across a basket of around 20 General Insurance brands. But when our team came to look at the data for 2021, our insights revealed some tough truths that needed a closer look.

What did we find?

NPS and CES are based on transactional feedback (i.e. feedback soon after the customer has had an interaction with the company) from customers at the primary touchpoints of new business, mid–term adjustment, claims and renewal. Our clients use this data to drive their operations and wider customer experience strategies.

With the latest set of results for Q4 2021 just in we can report a decline in NPS and Effort scores for the whole of 2021 – and it’s the first time we have seen negative growth after four consecutive years of steady improvement.

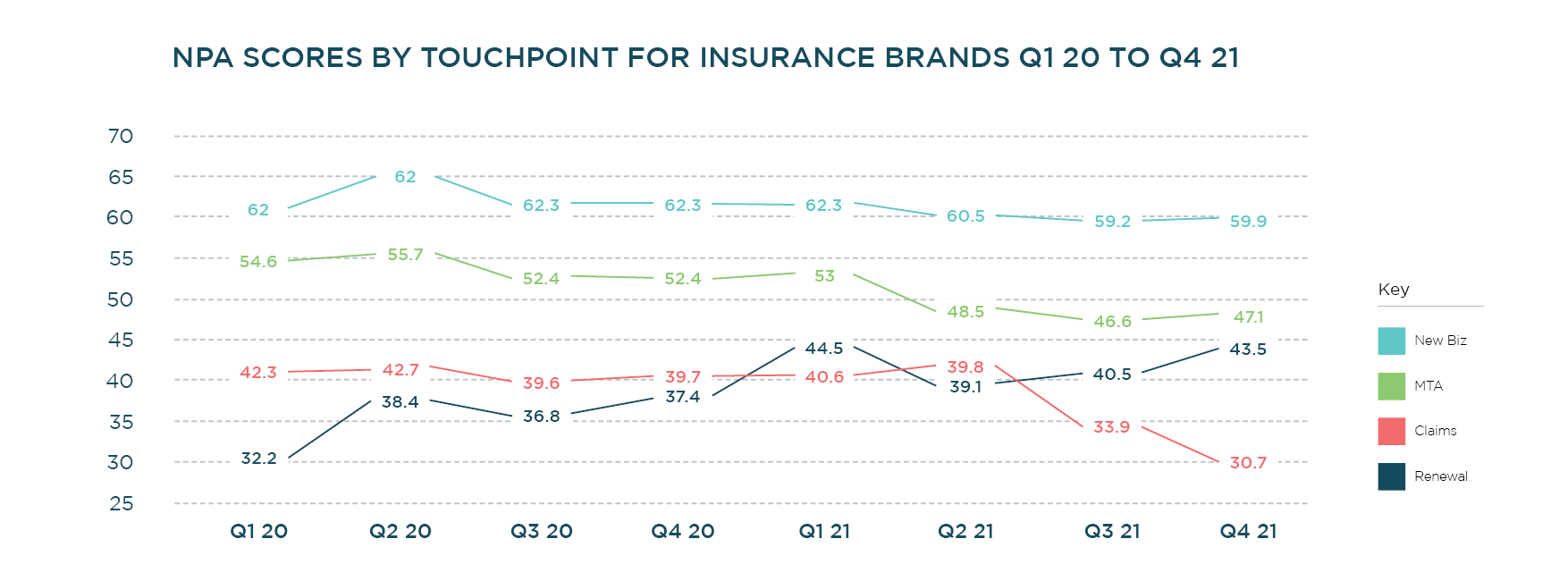

Looking more closely at the NPS numbers by quarter and by touchpoint (below) we can see that NPS across all four touchpoints enjoyed a peak in Q2 2020 – coinciding with the first impacts of Covid, widespread homeworking and the phenomenon we described as ‘Lockdown leeway’ (when customers were more forgiving of the service they experienced). Since then, scores have tailed off (with the exception of a rally in Renewal scores in Q1 21). The decline was especially severe in H2 2021 for Claims NPS, dropping over 9 points.

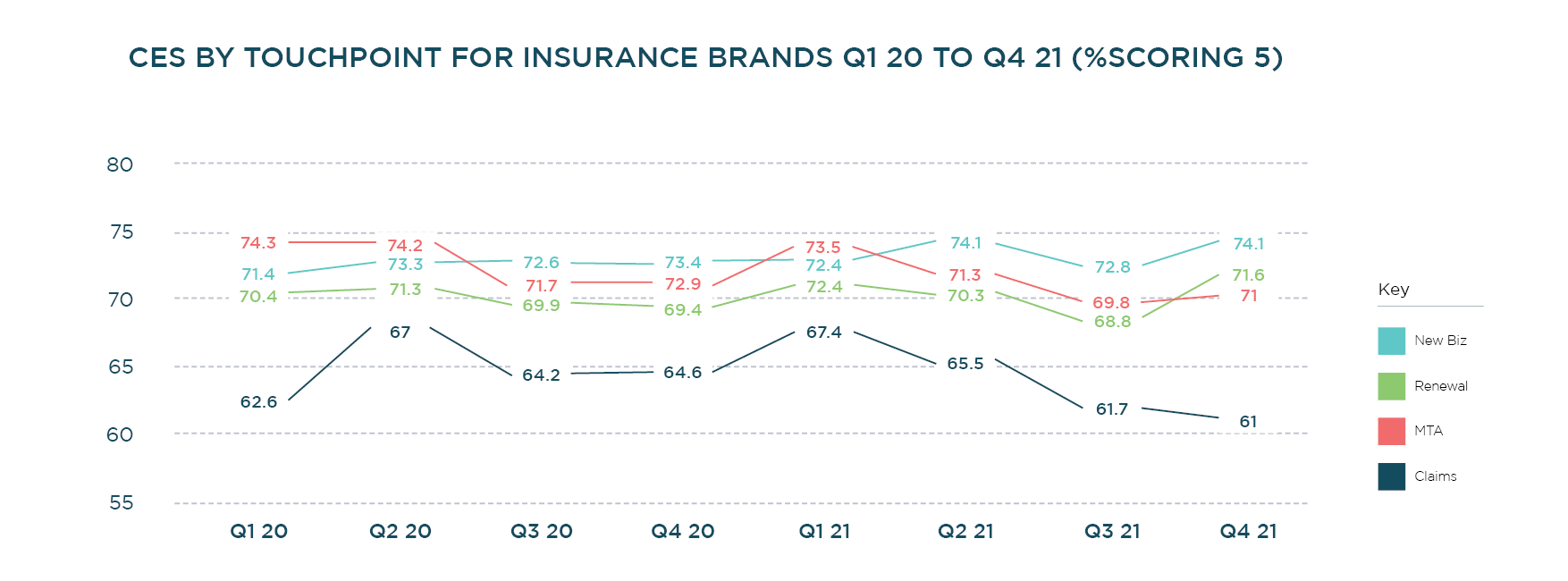

The trend for CES is broadly similar, but in this case there is a decline across all touchpoints with Claims, once again, the worst performer. We know there exists a strong correlation between NPS and CES so this decline is no surprise.

Why is customer satisfaction dropping?

Looking at the reasons that customers gave for low NPS, it is apparent that companies are struggling with a combination of increased volumes of claims and staff/process shortcomings. We’ve also seen an increase in comments about the time taken to repair items or resolve claims and the number of comments about ‘poor communication’ (suggesting staff under pressure or lacking experience).

Is the pandemic still a reasonable excuse for poor CX?

Despite being almost two years into the pandemic, it’s undeniable that some organisations are still struggling to adapt to the impact Covid has had on their business. The grace period customers gave to organisations is long but over and people now expect service levels to be back to where they were. In short, the pandemic is no longer a valid reason for disturbed CX and lengthy call handling times.

In fact, our recent research with Netcall, revealed that 82% of CX experts from Financial Services, recognise Covid as the accelerant to pace of CX change, and as a result, plan to implement new customer channels over the next 18 months. Keeping up with customer preferences is key and with changing customer behaviours and expectations thanks to Covid, 52% plan to introduce social video channels to their existing mix of touchpoints.

But has the pandemic changed attitudes?

Perhaps not all of these reducing metrics can be laid at the feet of business. We have seen some clients reporting steady internal metrics (such as response times, average call handling time, claims lifecycle times etc) but also a hardening of customer scoring – especially with respect to their NPS. This phenomenon may well be a reflection of a broader societal challenge which we are all facing as we emerge into an uncertain future – with interest rates, shortages and additional financial uncertainty for many influencing their overall demeanour and outlook.

Thomas Cowper Johnson

Insight Director

E. thomas.cowper-johnson@davies-group.com

L. https://www.linkedin.com/in/thomas-cowper-johnson-1599125/